Bolder Launch can help you establish an NGO, and this article discusses the tax implications of applying for charity status.

Dutch taxpayers can deduct a gift to an ANBI (public benefit organization) in their income tax return.

Please verify that the institution is an ANBI. You can learn more about it here: ANBI Program.

Donors may deduct periodic and regular donations to an ANBI

This article provides an overview of the fiscal distinction between periodic and ordinary gifts, as well as the tax treatment of a donation to an ABNI, SBBI, or ‘regular’ Association.

Periodic donations are fully deductible, restrictions apply to ordinary donations

For ‘ordinary/one-off’ donations, threshold applies, as well as a maximum allowed deduction. The donor can only deduct the amount above the threshold, and no more than the maximum amount.

The threshold amount and the maximum amount depend on your threshold income. That is the total of your income and deductible items in boxes 1, 2 and 3. If you file an online declaration, we have entered your threshold amount on the screen where you can deduct your donations.

The threshold amount is one per cent of your threshold income, but at least € 60. You may deduct what you have given more. Up to a maximum amount of ten per cent of your threshold income.

Conditions for deduction of regular donations:

- At least once a year, you transfer amounts to an ANBI or an association that meets the conditions. See regular donations to an association that is not an ANBI.

- The amounts are always equally high.

- You had the regular donation recorded before a civil-law notary or in a private deed of donation. See regular donations by a notarial deed or private deed.

- You make this donation over a minimum period of five consecutive years. This period does not apply in the event of death.

- You received nothing in return.

Regular donations have no minimum or maximum deductible amount.

You can also agree on a regular in-kind donation.

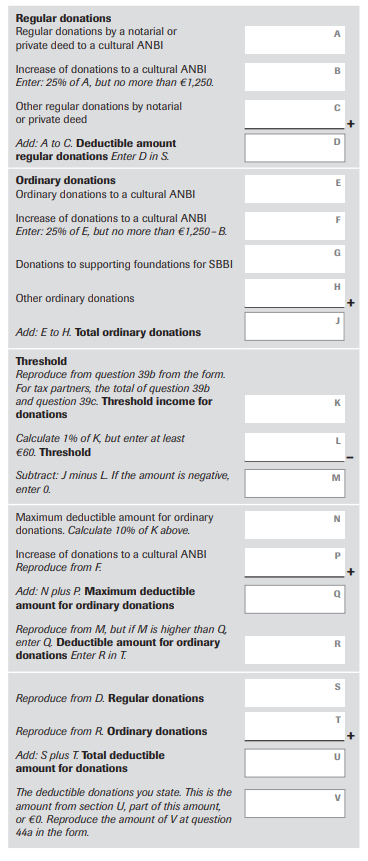

Below you find how tax deduction on a donation is calculated:

What is a donation in kind?

A donation in kind is a donation that is not monetary in nature, such as a coin collection, an art object or shares in a private limited liability company. You agree to make an annual provision when you make a regular in-kind donation. If you commit to providing a food parcel worth €60 every year, you are making a regular in-kind donation.

If you sign into the agreement, it should be defined and made plain to everyone what will be provided in terms of quantity and value for both the contribution in kind and the regular provision. This amount or value needs to remain constant over time. For example, an organisation that provides gifts to children in orphanages on St. Nicholas Eve (Sinterklaas) receives toys from you in the same quantity each year. You commit to providing five dolls, five stuffed animals and five children’s books each year for the next eight years.

The yearly provisions have the same amount each year, but the value can change. You may deduct the real costs of the provision each year in your income tax return because the amount of the annual provision is fixed. This may be worth €250 one year and €300 the next.

Extra deduction for a gift to a cultural ANBI

A cultural ANBI is engaged in art and culture. For example, a museum, library,or theatre. With our ANBI search program, you can determine whether an ANBI is cultural.

When calculating the deduction, you can increase a gift to a cultural ANBI by 25%. But only up to € 1,250.

The additional deduction is applicable to both periodic and regular gifts. Ordinary donations are subject to a threshold and a maximum.

Example: ordinary donation to a cultural ANBI

Your income threshold is € 35,000. The minimum amount is then € 350 and the maximum amount is € 3,500.

You make several small contributions totalling € 425. € 300 of this total is for a cultural ANBI.

You calculate your deduction as follows:

| You give in total | € 425 | |

| An increase of (€ 300 x 25%) applies to the donation to the cultural ANBI. | € 75 | + |

| Therefore, the total amount of donations | € 500 | |

| You deduct the threshold amount from this | € 350 | – |

| So, you may deduct in total | € 150 |

In this example, your donations remain below the maximum amount. You can, however, reach the top. For example, suppose you make several regular donations totalling € 4,000, with € 500 going to a cultural ANBI. The increase may then be added to the maximum amount. This is how it goes:

| You give in total | € 4,000 | |

| For the gift of € 500 to a cultural ANBI, an increase of (€ 500 x 25%) applies. | € 125 | + |

| Therefore, the total amount of donations | € 4,125 | |

| You deduct the threshold amount from this | € 350 | – |

| You would then be allowed to deduct without a maximum amount | € 3,775 | |

| But the maximum amount is | € 3,500 | |

| In addition, the extra deduction is added | € 125 | + |

| So, you may deduct in total | € 3,625 |

Example: a periodic donation to a cultural ANBI

You make a € 500 donation to a cultural ANBI on a regular basis. You can increase the deduction by 25 per cent, or by € 125. This will keep you well below the € 1,250 threshold, allowing you to increase the deduction to the maximum. That is, you can deduct € 625 (€ 500 + € 125).

Supporting Foundations/SBBI

A donation to a specific SBBI supporting foundation is tax deductible. A supporting foundation for an SBBI is a foundation established specifically to raise funds to support an SBBI’s anniversary in the fields of sports and music.

Conditions for deduction of ordinary donations:

- You made the donations to an organisation that is registered with us as an ANBI or a certain SBBI.

- You can prove your donations with, for example, bank statements or receipts. – You received nothing in return.

- The total amount of your donations exceeds the threshold.

- You may deduct no more than the maximum amount for these contributions. See threshold and maximum deductible amount.

What exactly is consideration? Did you receive anything in exchange for what you gave? In that case, the organisation took you into account. For example:

- You purchased a specialised cookbook from a patient’s association. You then did not donate. You paid money and received the book in exchange.

- You purchased a lottery ticket from the lottery. In exchange, you can win money.

When are you allowed to deduct donations as a volunteer?

Have you done any volunteer work for an ANBI? You may deduct an amount as an ordinary donation if you meet certain criteria. There are two possibilities:

- You were entitled to compensation for volunteering, but you declined.

- You incurred expenses but received no compensation.

What if you waive your fee for volunteers?

Were you entitled to a “volunteer fee” for your contributions to an institution? But did you agree to waive it? In that case, you can deduct the fee as a regular donation. However, in that case, you must be able to demonstrate that both you and the institution meet the following requirements:

- We designated the organisation as an ANBI.

- The ANBI has come to an agreement which allows you to be eligible for remuneration.

- The ANBI’s financial situation allowed it to pay the remuneration.

- The ANBI intended to pay the remuneration.

- You were able to decide for yourself that you did not want to receive the remuneration and instead donated it to the ANBI.

You incurred expenses and received no reimbursement

Did you incur ANBI expenses in 2018, for example, as a volunteer? And were you able to claim these expenses from this organisation, but you did not? In that case, you may include them as a regular donation. If the ANBI was unable to reimburse the expenses incurred, this will also be considered a donation. You may include a fixed amount of €0.19 per kilometre for car expenses you did not claim.

The same ANBI waives the fee for volunteers and does not provide an expense allowance. Were you able to waive a fee for volunteers while incurring expenses for an ANBI? In that case, you must deduct the amount of expenses for which you did not receive an allowance from the amount of expenses for which you did not receive a fee for volunteers. You spent, say, €750 on an ANBI. You also waived a €600 fee from this ANBI for volunteers. The deductible donation amounts to €600 + €150 (€750 -/- €600) = €750.

A regular donation to a non-ANBI organisation

A regular donation to a non-ANBI association is subject to additional conditions. You may deduct this donation if the organisation meets the following criteria:

- The association consists of at least 25 members.

- The association has full legal capacity.

- The association does not have to pay corporation tax.

- The association may be established in a nation that is a member of the European Union, Curacao, Aruba, Sint Maarten, Bonaire, Sint Eustatius, or Saba, or in another nation that we designate.

If you wish to know more, please reach out to our Launch crew.