Once you have started your Dutch business, it will (hopefully) not take long before you issue your first sales invoice. However, it’s important to consider the Dutch invoice requirements before you do this.

Why should you issue an invoice at all?

The most basic purpose of an invoice is to keep a record of sales. It provides a way to track the date a good was sold, how much money was paid and any outstanding debt. An invoice can also track which employees make sales and which items they sell. For VAT, the invoice is essential. When the invoice does not meet the requirements it is possible that the VAT is not deductible. The invoice has to be clear for you, your customer and the Dutch tax authorities. What are the requirements?

Obligated invoice information in The Netherlands

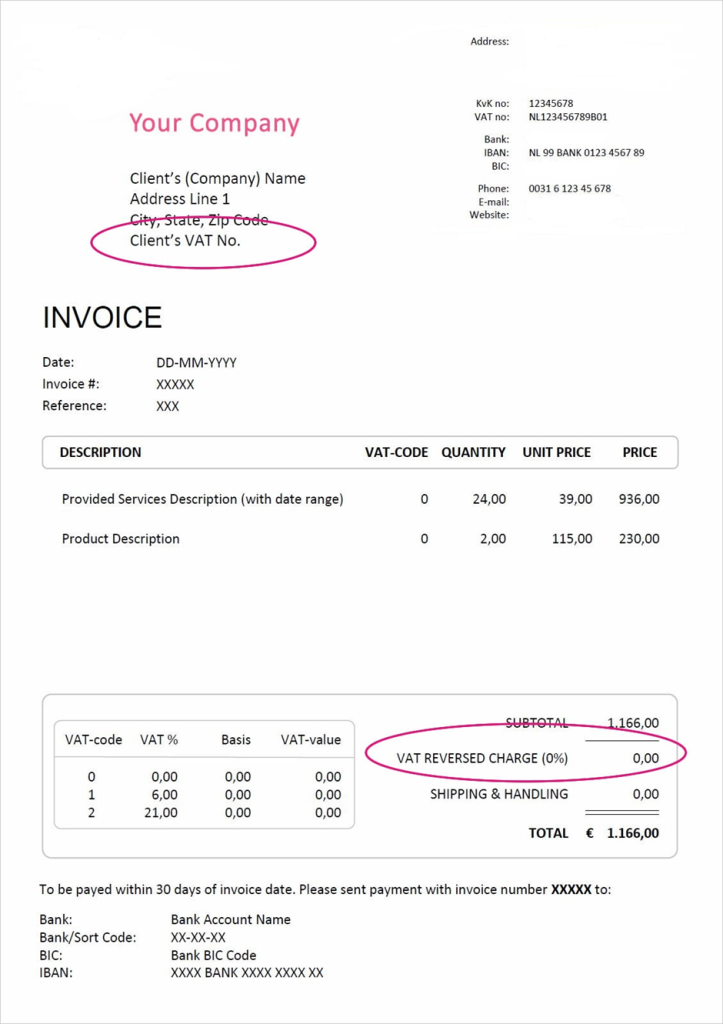

Invoices need to provide, at least, the below-mentioned information:

Header

- The complete name and address of the selling company;

- The complete name and address of the buyer;

- The VAT number of the selling company;

- The Chamber of Commerce number of the selling company;

- The date on which the invoice is made up;

- A unique, continuous and subsequent invoice number.

Invoice line

- A detailed description of the goods or services supplied;

- The amount of goods or time spent on services;

- The delivery date;

- The amount excluding VAT;

- The used VAT rate;

- The amount of VAT due.

All documents that meet the above-mentioned requirements can be considered to be an invoice.

Obligated invoice information in The EU and outside of The EU

When you are doing business from The Netherlands with another (EU) country, the invoice has to meet subsequent requirements on top of the already mentioned requirements. These subsequent requirements are:

- The VAT number of the foreign company

- VAT

- Services, VAT reversed charge (0%) has to be mentioned

- Goods, VAT exempt has to be mentioned

The encircled information is the extra information required when doing business from The Netherlands with another country.

VAT Declaration doing business from The Netherlands to another EU country

Doing business from The Netherlands to another EU country also requires an ICP VAT declaration. In this VAT declaration, the intra-community goods and services are mentioned.

Do you export goods to non-EU countries? Such supplies are taxed at 0% VAT. It makes no difference whether the goods are supplied to a private individual or an entrepreneur. You must be able to show from your administration that the goods have actually left the EU.

Not obligated but important to mention on the invoice

On top of the required information on an invoice, it is important to mention the payment conditions and the expiration date of the invoice.

Conclusion

An invoice has to meet certain requirements. When the invoice does not meet the requirements, it is possible that the VAT is not deductible. When doing business from The Netherlands to another EU country, there are extra requirements. And you need to have an ICP VAT declaration; for example, you need to mention your client’s VAT number on your invoice. If you have any questions regarding this subject please do not hesitate to contact us. For more information, you can also refer to this article.

This guide is part of Corporate Support in our Launch Guide.